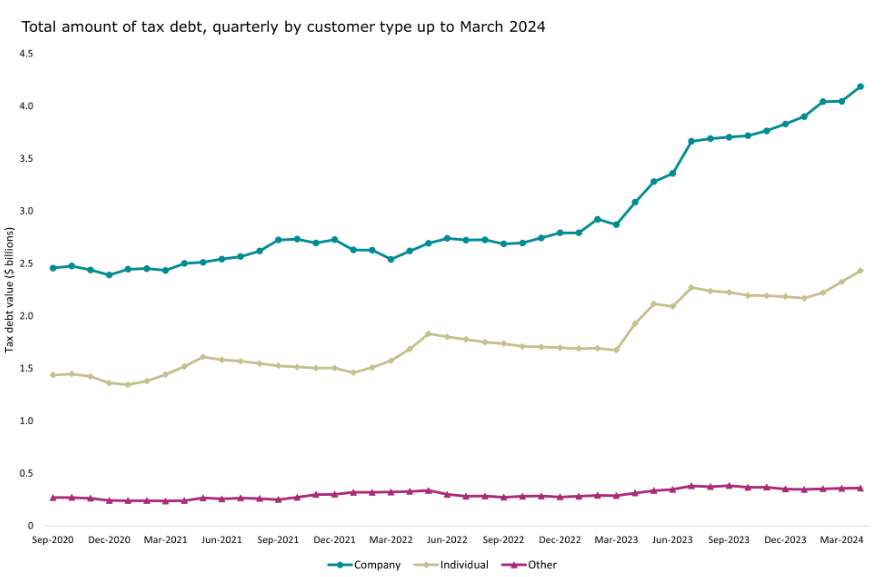

Each quarter the IRD release information about how many people owe them money and how much and it’s probably no surprise to heat that the amount of tax debt is trending up.

The number of people with tax debt increased from 436,000 in March 2023 to 551,000 in March 2024. That’s an increase of 115,000 people or over 25% more people. The total tax debt across all tax types increased from $4.8 billion in March 2023 to $6.7 billion in March 2024 so the amount owed has increased by almost 40%.

If you are having trouble paying your tax then you are not alone.

Below is the graph produced by IRD shows both company and individual tax debt is increasing.

Source: IRD Tax Statistics

But just because others are struggling with tax debt it does not mean that you should ignore your own tax obligations, and in fact you should be looking at how to pay this to avoid any potential issues should the IRD come after you.

Dealing With Tax Debt

The key issue with debt owed to the IRD is how they change both penalties and interest. This can see a relatively small debt increase to a much larger debt in a very short time.

IRD penalties for late payments are harsh – the IRD charges:

- 1% penalty on the day after payment due date

- 4% penalty for remaining tax including penalties on 7th day after payment due date

- 1% penalty every month the remaining tax including penalties is unpaid.

So after the initial 5% you are then being charged 12% per annum – plus the interest.

The IRD charges late payment interest currently at a rate of 7.30% and this is calculated as a monthly rate of 0.588%.

A lot of people look at the interest and think it’s not too bad, but if you add the penalties and interest then that’s 19.30% but also they will apply any payments to the oldest debt so that means even your current tax debt can quickly fall into arrears.

Financing Your Tax Arrears (Debt)

As a non-bank broker I’m often asked about tax debt.

When I say “often” there are not many weeks when I do not discuss tax debt and ways to finance the tax debt.

What I have learned is it’s not just about the actual debt, but many people with tax arrears find that this really stresses them and means it is hard to focus on their work and therefore the ongoing income needed to clear the current and future debts.

You can finance your tax debt in one of three ways:

- Making an arrangement with the IRD. This can be okay with small amounts, but these arrangements can put a lot of pressure on cashflow and if you cannot keep to the arrangement then the penalties continue to be added to the debt.

- You would think it makes sense to ask your bank for a loan or extension to a loan; however regardless how nice your bank might appear the banks will normally not finance tax debt.

- A separate tax debt loan – this is what we normally suggest and especially if you think it could take a few months to clear the tax debt, or if the IRD has already started to chase you to clear the debgt.

The preferred option is not to speak with your bank, but instead we can arrange a short-term loan to clear the tax debt and with the aim of then refinancing with the bank within 6-months.

While banks do not like to finance tax debt, they are normally quite okay to consolidate another loan into the existing lending.

I Can Help You Apply For A Suitable Loan

My name is Stuart Wills and I’m your non-bank broker.

I know lots of Kiwi’s like to do things themselves, but I would suggest that you leave this to an expert.

Normally I would not pop myself onto a pedestal, but I’ve helped so many people to get their tax financed that I’m pretty confident that I am the best option that you have.

When I look at how to best finance your tax debt I will be looking at what is possible, what is the most cost effective and ultimately what is best for you

It’s best to speak to me before talking to your bank or any other finance broker, but even if you have done one or both then still feel free to reach out an d just make sure that you tell me everything including who you have spoken to and if you know any bank or lender that has said “NO” to you